Creating value for all stakeholders through enhanced economic performance

Key highlights

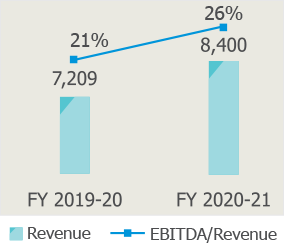

INR 8,400 Cr.

Revenue

INR 2,188 Cr.

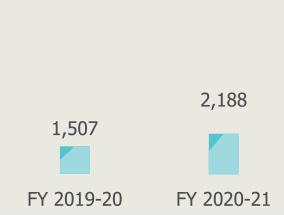

EBITDA

INR 1,198 Cr.

Profit After Tax (PAT)

EBITDA (INR Cr.)

SRF continues to maximise value for all stakeholders by the implementation of differentiated business strategies, optimum utilization of resources, strengthening business processes that aid in building a sustainable business model. The financial performance, including revenue, expenses, new future opportunities among others, are regularly assessed, monitored on a periodic basis and reported publicly wherever required. While growing as a profitable business, the funds generated are utilised to create value across all other capitals, ensuring that the benefits of growth are far-reaching.

The Company focuses on capitalizing opportunities by growing its market presence and current product portfolio. This enables SRF to deliver long-term sustainable returns to shareholders by increasing market capitalization and higher dividend pay-out. Optimum allocation and use of resources are the key focus areas within the Company. SRF’s internal policies for CAPEX proposal, investment policies, among others set the principles and facilitate prudent capital allocation. The Company continues to evaluate and implement various capital structure strategies, follow a balanced approach of equity and debt mix, generating healthy cash inflows, and building a robust balance sheet.

SRF strives to ensure optimum utilisation of financial capital across all its business verticals. The Company is constantly taking initiatives to boost productivity and achieve operational efficiency, thereby reducing operational costs and creating better returns for shareholders. To achieve this, SRF is strategically focussing on initiatives such as digitalisation, energy efficiency, waste management, etc.

Through continuous focus on strengthening its financial capital, the Company has attained a key position in the industry across all business verticals and plans to move in the same direction to sustain its position in the future.

To read more on the details of financial performance of the Company in the Consolidated section, click here

Implications of COVID-19 on economic performance

The COVID-19 pandemic has been an unprecedented crisis in human mankind and has affected individuals, businesses and countries globally. The spread of the pandemic reshaped the social norms and attitudes and plunged the world economy into a downturn.

Due to the pandemic and subsequent lockdown, the Company witnessed slowdown in demand for products across sectors, leading to significant reduction in cash inflows and sales, thereby impacting the overall revenue of the Company.

SRF has been relentlessly and proactively focusing on enhancing its financial strength and minimizing the impact of the pandemic on its operations. The Company operated during lockdown in compliance with the advisories issued by the Government of India and local authorities, ensuring high levels of health and safety for its workforce. The Company carried out fund flow planning and enhanced short-term and medium-term borrowing to mitigate risks pertaining to liquidity. SRF ensured close monitoring of customer demand and production capacity and maintained an efficient product mix by prioritising product manufacturing.

Going forward, the Company will continue to monitor the volatile environment, as it evolves, and take necessary measures to ensure business continuity.