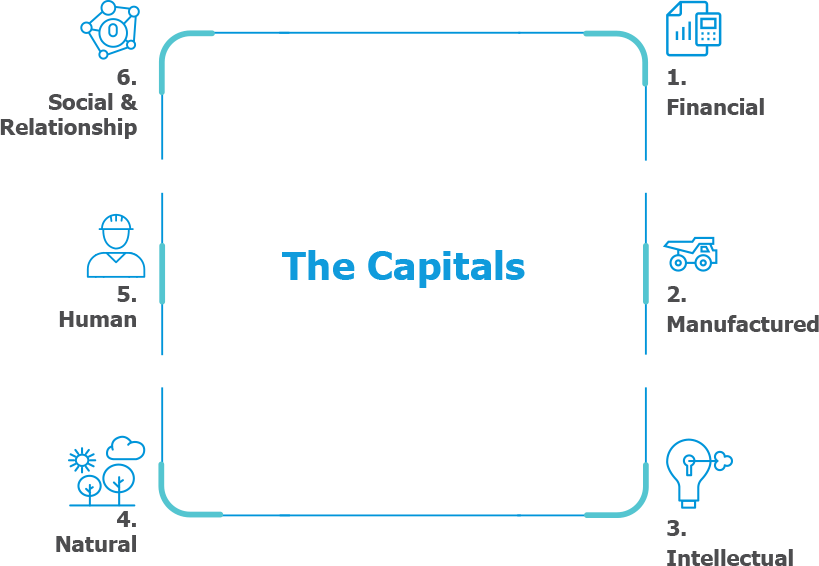

The Six Capitals

The Company has reported its performance across the six capitals of the IR framework, namely Financial, Manufactured, Intellectual, Natural, Human and Social & Relationship. All these six capitals have created a strong base, further aiding growth and value for stakeholders. These capitals are an ideal blend of top-tier talent, state-of-the-art manufacturing capabilities, cutting-edge technologies, world-class R&D facilities, strong financials, robust governance practices, and transparency.

At SRF, we follow a rigorous resource allocation method which is a result of meticulous planning, evaluation and conscious efforts for achieving desired return on investments which ensures the best results. This report demonstrates the performance and progress of SRF across the following six capitals against the identified material aspects:

1. Financial Capital

- Sources include debt and equity financing and cash generated by operations and investments

- Funds are being invested in various CAPEX projects throughout the business

2. Manufactured Capital

- Investments are focused on expansion, bringing efficiency and upgrading existing equipment and infrastructure

3. Intellectual Capital

- Huge investments focused on the sustainability and innovation agenda for a competitive edge

- Due assessment of the returns on investment against the extent to which it might aid business growth

4. Natural Capital

- Natural capital inputs such as raw materials, water, fuel and renewable energy, etc., critical to operate efficiently

- Allocation of financial and human capital to secure long-term availability of the inputs

5. Human Capital

- Investment in hiring the right people for the right job so as to maintain its status as ‘employer of choice’

- Assessing the necessary skills and specialisation to deliver on the objectives

6. Social & Relationship Capital

- Fundamental part that the stakeholders play in creating and sustaining an enabling external environment for the business to flourish in

- Consideration of all relevant factors while making investment decisions