- Home

- Value Creation

- Financial Capital

Financial Capital

The Company’s strategic actions continue to exhibit SRFs dynamic financial management which is in line with its long-term and short-term goals. As one of the leading players in the industry, we continue to offer strong financial performance, both in terms of growth and profitability.

Material Issues Impacted

Economic Performance

Inputs

- Operating Cost – ₹ 9,068 Cr.

- Net Debt – ₹ 2,888 Cr.

Outputs

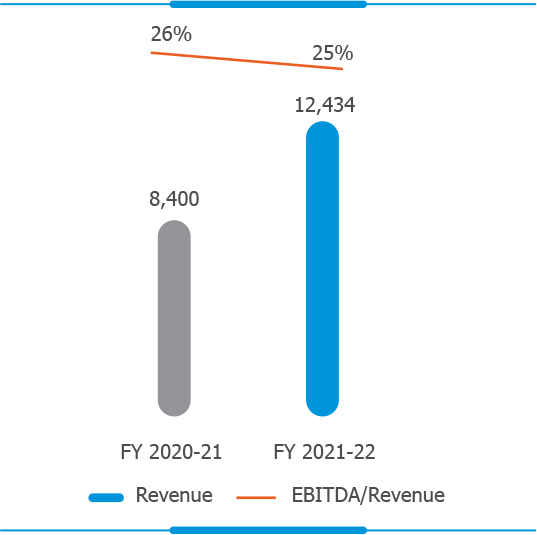

- Revenue – ₹ 12,434 Cr.

- Cash Generated from Operations – ₹ 2,106 Cr.

- Dividend Pay Out – ₹ 212 Cr.

- Profit After Tax (PAT) – ₹ 1,889 Cr.

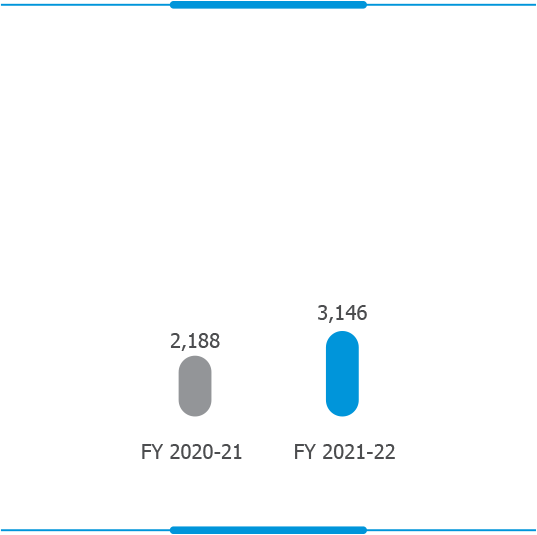

- EBITDA – ₹ 3,146 Cr.

At SRF, we firmly believe that combining operational excellence with prudent financial resource allocation is critical to long-term value creation. We channelise our efforts towards maximising value for all stakeholders by implementing differentiated sustainable business practices, optimal utilisation of resources and maintaining a strong balance sheet. SRF has been focusing on growing its market presence and expanding its product portfolio by building a solid long-term sustainable business model. The Company has ensured uninterrupted business operations by mitigating business risks at source and generating returns sustainably for shareholders. We have employed prudent financial management strategies, such as sensible allocation of funds across various capitals, technology-led investments and smart branding that has allowed us to generate higher financial returns consistently and build long-term value for our stakeholders.

The financial performance, which include - revenue, expenses, and new future opportunities, is monitored and evaluated on a regular basis, and reported publicly as and when required. While securing its position as a profitable Company, the funds generated are used to create value across all capitals, guaranteeing that the benefits of growth have a ripple effect across the Company.

The Company’s focus areas are resource allocation and utilisation. Internal policies of SRF, such as those for CAPEX proposals and investment rules, establish the concepts and promote sensible capital allocation. The Company continues to assess and implement various capital structure options, maintaining a balanced equity and debt mix, producing strong cash inflows, and creating and maintaining a strong balance sheet. Our major goal is to provide our shareholders with a long-term favourable return on investments, and we ensure that any material developments that could have a negative impact on our financial position are reported and translated in our business strategies.

SRF works towards achieving optimum utilisation of financial capital across all its business verticals. The Company has taken various interventions to increase productivity, improve operational efficiency, progress towards digitalisation which in turn reduces operational cost and enhances the return value. All the stringent efforts implemented by SRF over the years and the robust financial planning has helped us in attaining an increase of 48% in revenue and ~44% in EBITDA over FY 2020 - ‘21.

Revenue & EBITDA/Revenue (₹ Cr.)

EBITDA (₹ Cr.)